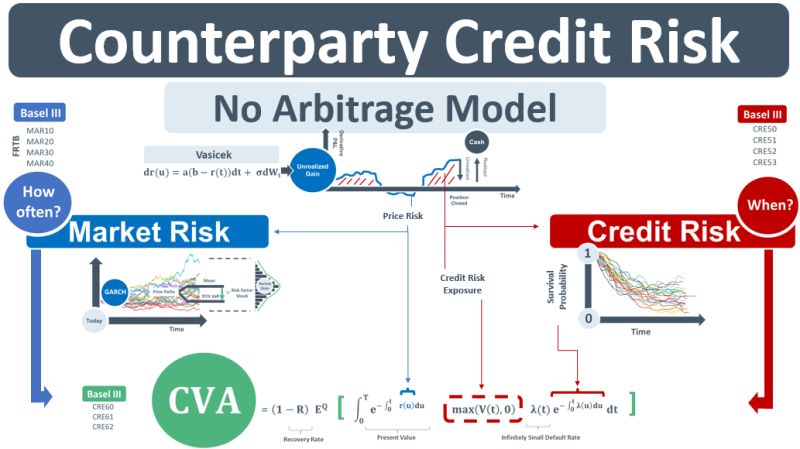

Counterparty credit risk is a fusion of market risk with credit risk.

The unrealised P&L of an interest rate derivative is booked each day by the Product Control team responsible for the daily financials of the Rates desk. The P&L is dependent on the random change of an int rate, dr(t). The Vasicek no-arbitrage term structure model is used to generate the rate changes. Because the changes are random, the derivative is exposed to market risk. And because the P&L is unrealised, the net gains are exposed to the credit risk of the trade counterparty.

The market risk capital of the price risk associated with the rate change is calculated using a value-at-risk simulation that asks “how many” times the rate changes, dr(t), are likely to generate losses that exceed a threshold. Credit risk asks a different question. It asks “when” will a default occur and is calculated by simulating a probability survival curve. The market risk question of “how many” and the credit risk question of “when” are answered using mathematical integrals.

Beneath the market risk and credit risk concepts sits the credit valuation adjustment (CVA). CVA is the upfront fee that the desk charges the counterparty for the expected counterparty credit risk (CCR) exposure generated by the unrealised net gains over the life of the trade. The fee is calculated using a CVA model. At the core of the model is the simulation of the expected exposure. It fuses the market risk integral with the credit risk integral.

The market risk part of the CVA simulation uses the integral to sum thousands of infinitely small interest rate changes, r(u). They create the expected net gains on the derivative. The credit risk part of the simulation sums the infinitely small default rates, λ(t), to create a survival probability curve which decreases over time as the likelihood that the counterparty defaults increases.