Of course it makes sense, but trading systems each have their own product codes, there are various in-house product classification and categorization schemes that have evolved over time, financial data vendors have proprietary product codes and ISDA, ESMA and ISO each provide industry standard classifications too. That’s the starting point for most banks when looking to improve transaction and risk reporting with the help of a financial product taxonomy solution.

The challenge of a workable product taxonomy across the bank is increasingly coming to the attention of Chief Data Officers. It’s critical, from the perspectives of regulatory reporting and management information, to be able to categorize everything that has been sold or traded by the bank in any given period. The challenges include myriad levels of granularity and hierarchies that exist among the many product classification and code schemes in use. The essential requirement is that the financial product taxonomy solution is able to identify and make visible the unique attribute by which it can be categorized.

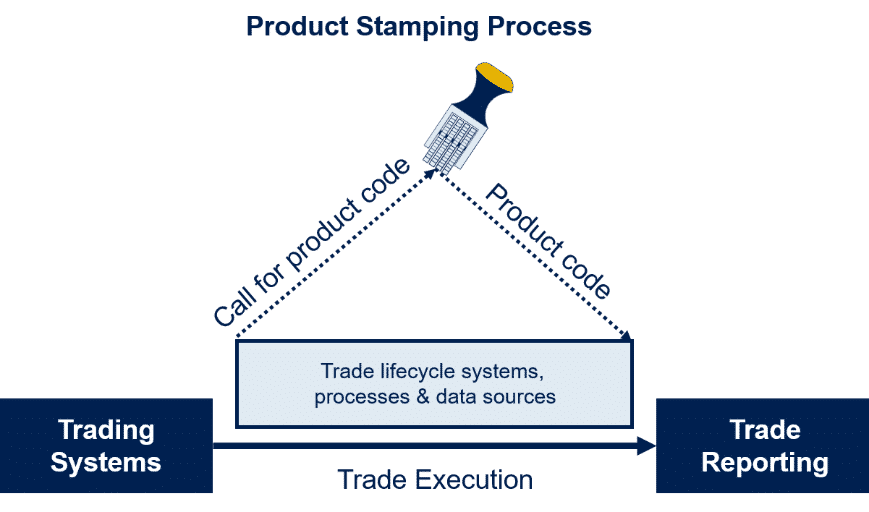

Post-trade product stamping, i.e. assigning a product classification for straight through processing in transaction reporting and risk management, is a key use case and often the litmus test of a good financial product taxonomy solution. Doing business faster, because product onboarding is completed quicker, is the key commercial benefit from a practical product taxonomy.

All non-GoldenSource systems can access the standardized product codes via the product taxonomy and product stamping service made possible by GoldenSource Product Master, which means that accurate product information is always available across all business systems to support product-related processes.

![]() Connections & Adaptors is a robust, preconfigured adaptor that loads vendor data into GoldenSource’s EDM GoldenSource Security Master or Client Onboarding applications. Our Connections are ready to receive and process your vendor feeds immediately upon installation, no mapping required. Read more…

Connections & Adaptors is a robust, preconfigured adaptor that loads vendor data into GoldenSource’s EDM GoldenSource Security Master or Client Onboarding applications. Our Connections are ready to receive and process your vendor feeds immediately upon installation, no mapping required. Read more…

![]() GoldenSource Product Master Module meets the challenge of efficient sourcing, onboarding and cross-referencing of information from diverse sources and systems. Seamlessly manage related workflows and consolidate, analyze, audit, update and distribute key product information to every sector of your company simultaneously. Read more…

GoldenSource Product Master Module meets the challenge of efficient sourcing, onboarding and cross-referencing of information from diverse sources and systems. Seamlessly manage related workflows and consolidate, analyze, audit, update and distribute key product information to every sector of your company simultaneously. Read more…