GoldenSource Market Data Management Solutions provide a centralized market data infrastructure that ensures data, valuation, and risk calculation integrity, regulatory consistency and ease, and optimization of market data costs. The solution empowers users to manage data directly through an efficient, user friendly UI, delivering confidence through clean, consistent, quality data to satisfy investor and regulatory obligations – for less of your time.

At a high level, fragmented market data infrastructure leads to myriad issues that cost time and money:

Without centralized market data, users are at risk to miss their SLA’s for end-of-day valuations and pricing, leading to operational and regulatory impact. GoldenSource Market Data Solutions help you ensure that doesn’t happen.

Our clients achieve greater accuracy in risk management and reporting. Across the capital markets, firms are using GoldenSource to scale to meet more frequent reporting requirements and higher trading volumes, launch new products and improve risk allocation.

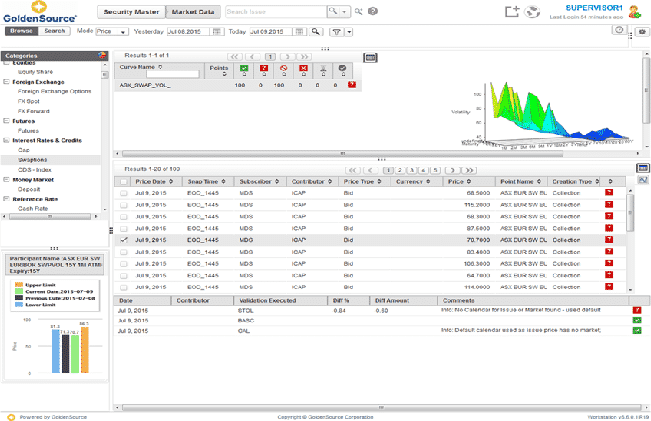

The complete solution for gold copy and multi-sourced pricing. Flexible rules for requesting, loading, validation and golden price creation of vendor and in-house price sources. Validations include stale price, day-over-day tolerance, cross-vendor, calendar, price type checks statistical checks and conditional rules. A centralized Suspect Handling UI supports review, correction, audit, and approval of pricing exceptions across multiple valuation dates. Includes built-in Vendor “Price Mappings” covering price feeds for all major vendors. Our “Price Master Solutions” includes modules for Pruval, Bond Proxy, Bid-Ask, IPV, Valuation Impact, NAV Impact functionality.

![]()

Utilizing GoldenSource’s unique underlying data model, the functionality includes visualizing, zoom and validation for both individual points on curves/surfaces as well as whole-curve validations (curve validity, smoothness, parallel shift checks). The module comes with in-built interpolation, bootstrapping capabilities. Our “Curve Definitions” module offers packages for best practice starter set curve/surface definitions, mapped to multi-sourced vendor identifiers + meta data and screens to manage all related curve reference data.

Time-Series Master is a tool for managing vendor and gold copy historical time-series data. It supports the loading, validation and gap-filling of historical time-series as well as adjustments to time-series for corporate actions. Validation methods include checks for missing prices, long and short stale price checks and various statistical methods (rolling Z-scores, EWMA) for confirming the quality time-series.

![]()

Quant Workbench comes with three separate functions: 1) A Python-based IDE (“Integrated Development Environment”) which allows access to the underlying data via a Jupyter Notebook specifically designed to take advantage of GSOs, 2) QLI Frames: allows customers to import GoldenSource data frames into their own Python IDEs or Excel books for the purposes of risk or analytics development, 3) QLI Derivations/Validations: allows customers to integrate quant/statistical libraries into the market data validation process