As modern asset management firms look for new databases to meet the needs of the emerging personas within their firms, more and more they are looking at cloud data warehouses. However they are finding that the standard offering is not aligned with the expectations of the folks tasked with rolling out the cloud data transformation to end users.

Industry organizations have attempted to address this by setting frameworks to help firms know how to organize data within a cloud data warehouse. The EDM Council last fall issued a framework to manage data in the cloud by setting standards, controls and best practices.

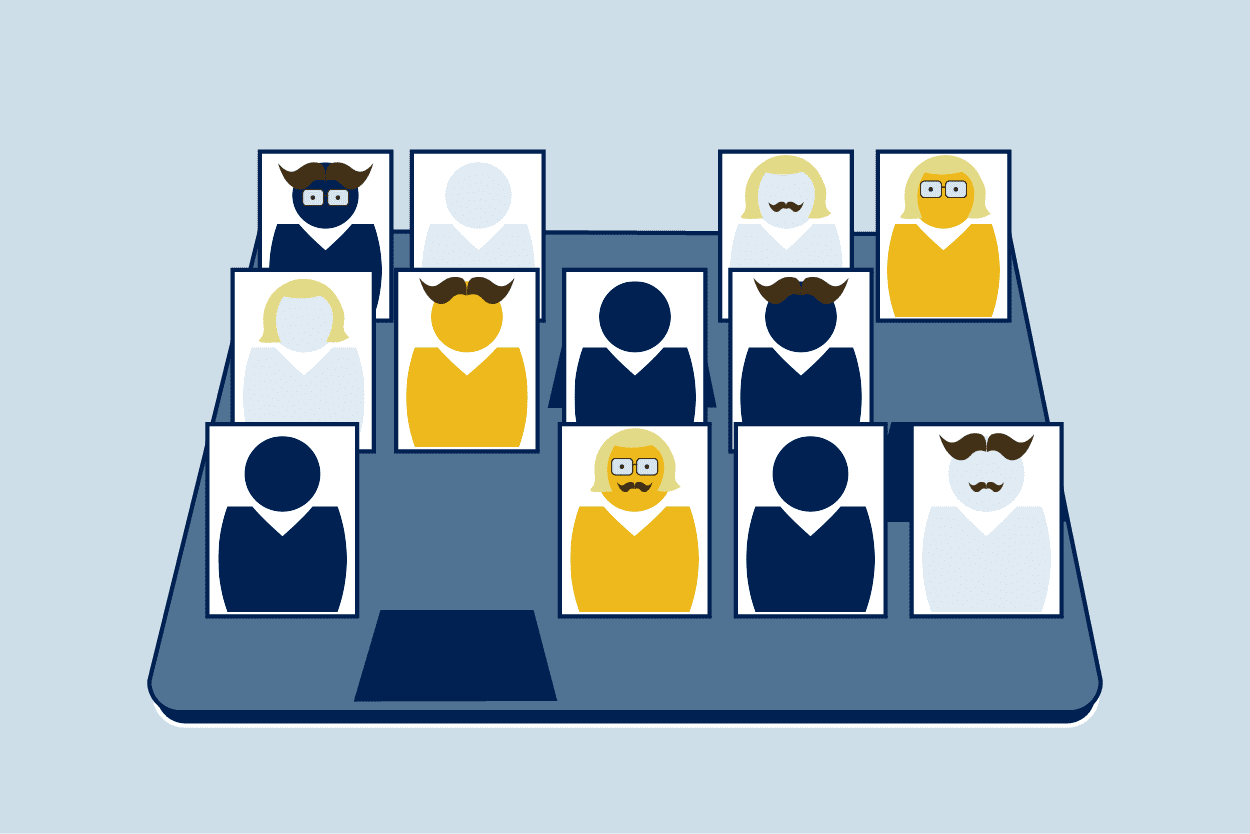

Data managers might need something more, however, and the answer lies in understanding who is using the data and to what end. In user experience design, personas contain behavior patterns, goals, skills, attitudes and background information that when put together, create a portrait of the user – and financial firms should use these personas to help relate to their users’ needs.

Who is using this data?

The first group using this data are risk management and quantitative analysts. These users may want the ability to take in data and see & interact with it in a cloud schema, or a raw, analytical format. For example, when indices, pricing, or customer holdings data is pulled into the system, they may not want it highly normalized and structured; all they want is a business information layer to control who has access to the data and make it possible to audit the data within the cloud data warehouse. From there these users can plug into their local toolkit of choice to make risk models, risk management, analysis, and signal generation. Historically, these users have simply gone out and acquired this data in a raw format independently from data vendors, leading to issues with efficiency, duplicate data, cost, and regulatory concerns. In the near term, this group is the primary driver of cloud data transformation.

Once firms overcome the initial problem set of the cloud schema, the cloud data warehouse will be exposed to other personas within the firm such as portfolio managers. With that, the requirements for the data inevitably change and the data will need to be more structured and organized. Portfolio managers need highly cleansed, highly structured, easily consumable data to run reports, allocate assets and make investment decisions. Data in this format has historically been available through traditional enterprise data management systems, but rarely lived simultaneously alongside the raw data format.

Who could use this data?

Cloud data warehouses also make it possible for certain financial professionals to get data they weren’t receiving before. A front-office equities manager, for example, might want fixed-income research data, but they simply aren’t getting it because their firm has siloed what they will receive. In the past, that type of fixed-income data would be owned only by the fixed-income desk. Having a mix of data from different sources covering different topics better informs the investment decisions of such a front-office equities manager.

Other potential users are sales and marketing professionals, who get more access to better data generated by customer relationship management systems underpinned by a cloud data warehouse. Firms can then design better products – ones that might fill gaps in the marketplace – by better addressing investor preferences. While this user group may not be the primary or secondary driver of the cloud data transformation, they (and their firm) can certainly benefit greatly from getting more access to quality data.

The problem – and the solution to cloud data transformation

The challenge is deciding on the right infrastructure for the use cases within the firm now, while also being scalable to future needs. GoldenSource’s Cloud Data Services (CDS) addresses the need to access the same data in different formats to different personas with different needs simultaneously, while also future-proofing firms from changes or evolutions as they grow.