Two weeks back we reviewed ESG scores and ratings after the FCA expressed their concerns a year ago, and left off asking the question “if the industry now has access to a much broader depth and breadth of ESG metrics than it ever has before, why has the discussion around greenwashing been growing over the past year?”

The simple answer is: the increased accessibility of ESG metrics, details, and methodologies have given the industry a deeper understanding and insight into how greenwashing manifests itself.

How we got here

Referencing those early scores of yesteryear, firms used to be able to dilute their ESG scores by flooding the zone with ESG metrics they are obviously good at, particularly where they aren’t of concern to the firm. In response, regulations started the next level of conversation about greenwashing.

The EU taxonomy had a breakdown at a topic level what firms should be concerned with with respect to sustainability principles, and introduced the “Do Not Significant Harm” (DNSH) and “Minimum Safeguards” concepts. The former specifically calls out things like, for example, boasting reduced carbon emission in a company’s operation while contributing strongly to deforestation, and the latter seeks to address, as another example, textile companies improving environmental goals while at the same time employing women at a wage significantly below what makes a living.

A vetted set of main criteria helps call out those who greenwash, not only with respect to climate, but also other environmental aspects like water purity, air purity and biodiversity, as well as social factors. In addition, the broad implementation of the Scope 3 concept into disclosure guidelines has made it increasingly difficult to push disadvantageous metrics down to anonymous suppliers to keep the company’s ESG rating pristine.

Advancement in standards and technology

As a result, the industry created clearly defined formulas for aggregating investment-level metrics, such as the standard “household metrics” of “carbon intensity” and WACI (weighted average carbon intensity), which is putting the portfolio’s carbon emissions in relation to its revenue. A powerful tool for comparing companies’ GHG efficiency particularly within the same sector.

They also established formulas aggregating physical and transitional risk to investors, as defined by the Mike Bloomberg-chaired Task Force on Climate-Related Financial Disclosure (TCFD).

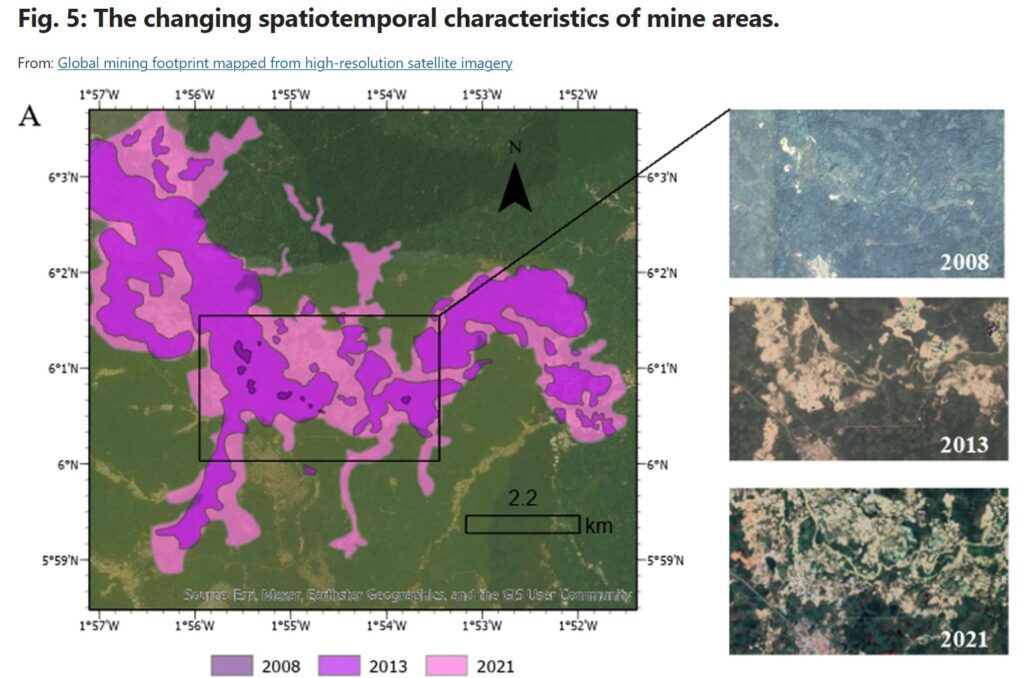

Finally, technological advancements further evolved how we view and understand ESG data. Satellite observation paired with AI has recently been able to call out false claims, like allegedly environmentally-friendly plantations or mining activities not contributing to deforestation as you can read about here.

Internalizing the data

As this data became more available and more firms began bringing it all in, they started to develop their own understanding of its intricacies and details – how one interacts with another and, in a larger sense, what effect other factors and data points have on those metrics. They began asking the question “How do I know this data is good enough?”

To answer this, they took a proactive step: applying the already existing concept of diversifying data feeds from multiple data sources to ESG data – much the same way they would with market, pricing, and reference data. This was beneficial in many ways, especially in that the credit risk agencies, where some of this data comes from, are already more scrutinized and regulated, ensuring a higher baseline quality of data. It also allows firms to more easily catch and action outliers like those mentioned above.

Now for firms this is no longer just about satisfying the regulator, it’s about making the right decisions for themselves, what they state externally, what they promise to investors, and how they respond to their clients. To a large extent it is this growing availability and reliability of data and methodologies which brought greenwashing in the spotlight and caused the conversation to become so prominent in the last year.